What will the in-house IP Team of 2025 look like? What should it look like?

Today Rouse Consultancy is launching a series looking at how in-house IP will change and will need to change as the businesses they serve, the environment in which those businesses operate and the IP service provider landscape all change around them.

We will be asking this question through the lens of consumer brand owning multi-national corporations (MNCs). Today, two-thirds of the world’s top 100 brands come from the US and EU. That will change too, and we will also be looking at what lessons western MNCs must learn from Chinese and other developing market MNCs.

We will be asking this question through the lens of consumer brand owning multi-national corporations (MNCs). Today, two-thirds of the world’s top 100 brands come from the US and EU. That will change too, and we will also be looking at what lessons western MNCs must learn from Chinese and other developing market MNCs.

This is not a series about COVID-19. The immediate impact of COVID-19 on IP team payrolls and budgets has been well covered. We are casting our eyes further forward, to five years from now, when (we all sincerely hope) COVID-19 itself will not be present but will have been but one driver amongst many that will have shaped the in-house IP team of 2025.

What will this article be examining?

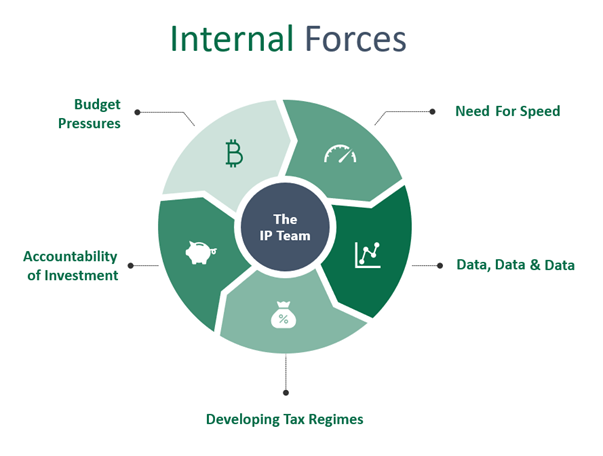

Our starting point is where in-house IP teams were heading as we entered this decade and what forces were driving this. We consider those from three perspectives: internal forces within the business; the forces acting on the IP service provider market, such as deregulation and disintermediation; and, finally forces external to the business such as geopolitical, macroeconomic and technological forces.

And the end of the journey is 2025. That does not seem far away, but such is the pace of change on so many fronts today that we believe that predictions beyond that are foolhardy or at least less meaningful.

This is more than just crystal-ball gazing. We are basing our hypotheses on conversations with clients during the COVID-19 crisis and our understanding of their commercial objectives before this all began. Across many dimensions we already have our research team gathering data to support – or challenge – those hypotheses.

We also welcome debate. Many will have their own views and own data. Please add them in.

Why are we doing this now?

COVID-19 has already shaken up perspectives and, for many, cut budgets or headcount. This has happened against the backdrop of the growing significance of intellectual assets in the last 20 years. We all feel this. We all see it in the ever-increasing value of intangible assets. To reference but one statistic: intangible assets represent 84% of total asset value for S&P500 companies. And in a post-COVID growth-challenged world the expectation is that intellectual asset rich businesses will offer the better growth opportunities and be more resilient than those heavily dependent on 20th century asset classes.

But we sense a growing misalignment between the importance of intellectual assets and the influence of in-house IP teams. Rarely are heads of IP ‘at the table’ with the CEO. And even when they are it can be difficult to articulate the connection between the headline value of intangible assets in the accounts and the work of the IP team.

Fundamentally we believe that as a community we need to do more to be ‘at the table', to better understand and express what the role of the IP team should be, why the business should be investing more in intellectual asset management and what the return on that investment will be. This is not for self-serving reasons, but because we all believe that it will make the businesses we work for and serve more effective, more agile, and ultimately more successful. Intellectual assets power the knowledge economy and if they are not well managed, value and competitive advantage simply leak away.

Where were we on 1 January 2020?

In the remainder of this article, we look at some of the key forces already present as we started this decade, before you-know-what came and tore up the 2020 planner. We start with internal forces; those present within businesses.

What are the internal forces?

1. Pressure on budget

1. Pressure on budget

Perhaps the most constant refrain from the IP teams in a wide range of clients and businesses that we speak to is the pressure on budget. COVID-19 has only increased that with 25% of in-house counsels seeing a reduction in budgets as a direct result. Most commonly sitting within the GC’s team, the IP team seems to be too often characterised simply as a risk management function. When not associated with creating value or exploiting opportunity, arguments for more budget commonly fall on stony ground. In our experience with clients, IP budget is rarely if ever assessed with reference to intangible asset value or ambitions of increasing that value. Mostly the starting point is last year’s spend, and how much can be shaved off. For some it must be built from zero up each year. Without a fundamental change to the perception of the IP team, the dynamics of this conversation will not change.

2. The need for speed

Agility and responsiveness to the market and competition are critical for business. This means pressure on the whole product and service development cycle from R&D and product development to marketing and sales. Faster feedback loops, more data available more quickly, the aim to pre-empt consumer need: All this means there is a premium on the speed of response from the IP team. Time zones can be challenging for MNC IP teams – a theme we will return to – but many IP teams are prioritising responsiveness. However, we see this coming at a cost. Higher demands and limited budget means almost all efforts are spent on day-to-day work with ever more limited time and space to think strategically, to be asking those questions about the wider impact and value of the work being done.

3. Data, data, data

The role of data in businesses today is increasingly significant. Across the business data informs decision making and supports value generation. Within the IP team this means an increasing need to understand data as an asset to be leveraged in the business, to understand the proprietary rights in and regulatory framework around data and to understand how data can drive the IP team’s own decision making. In this last respect, our observations are that many IP teams are yet to fully embrace this.

4. Greater accountability of investment

As corporate reporting practices develop, we see this as the decade where there will be a great leap forward in the accountability of the C-suite for the investments being made in intangible assets and the return on those investments. Accounting practices remain misaligned with much lumped into goodwill, but as the last decade closed we were seeing progressive MNCs publishing more information and providing more transparency on intangible assets. What we see from IP teams is surprisingly little involvement and almost no leadership in these developments, with the CFO at the helm instead.

5. New approaches to IP ownership and tax

The 2010s was the birth of the OECD BEPS Project, seeking to minimise tax avoidance by MNCs through the use of IP. The regulatory regimes have begun to mature with increasingly sophisticated responses from MNCs to minimise tax exposure. This again is a space in which we rarely see IP teams deeply involved, and so is another context in which strategic discussion about IP happen outside the IP team.

What’s happening in the IP services market?

In this section we look at the major forces present within the IP services and how they are changing IP teams as the decade begins.

In this section we look at the major forces present within the IP services and how they are changing IP teams as the decade begins.

1. Deregulation

Deregulation of legal services and legal business ownership has become increasingly present in the last decade. Long gone are the days of a single advisor (law firm or trade mark/patent agency) handling all elements in the value chain from searches and clearance/FTO to applications, prosecution, disputes, enforcement and litigation.

In particular, corporate owned businesses have begun to breakdown the value chain into slices, typically developing offerings built around scale, efficiency and technology. Renewals were an early example; online monitoring and takedown is a more recent example; we are now seeing non-legal service providers offering portfolio and agent management services, building consulting services on top based on the data extracted from the management platform The ability to execute on these unregulated or likely-to-become-unregulated opportunities is almost exclusively the preserve of corporate vehicles able to raise finance to drive scale. The massive flood of capital into this space in the last five years has driven acquisitions and consolidation, leaving traditional legal services partnership structures far behind in being able to compete in this space. And we expect more to come.

2. Delegalisation

Related to deregulation, as the broader IP services value chain matures, we are seeing other businesses – such as strategic consultancies, insurance businesses and even e-commerce platforms - extend their core offering to include IP related services, such as valuation and IP strategy and trade mark filing, bringing them into direct competition with IP consultancies, IP legal service providers. As we have seen consultancies establish large legal teams, reaching deep into the corporate/commercial legal services pot, we can expect this to happen within IP legal services as well.

3. Disintermediation

MNC consumer brand-owning business have historically had long rosters of legal/IP service providers globally, servicing their needs in each country. Many businesses use coordinating agents to manage all the liaison, adding another layer and putting the MNC itself two steps away from the IP office receiving their application. Nascent as the turn of the decade, we are seeing the possibility of direct filing services - which support businesses filing directly with IP offices – become a reality as IP offices now widely accept electronic filings and, going further, open APIs to allow for filing directly into the system and not just into an inbox. This raises the likelihood of significant disintermediation and therefore cost saving for corporates, at least in relation to filing.

What are the external forces?

Wrapping themselves around all the factors identified above, businesses and all within the IP services market are exposed to macro-forces and the great technological changes taking place. There are many that could be mentioned here; we touch upon those that we see as particularly significant from the perspective of IP and intangible assets.

1. Deglobalisation

With rising nationalism amid discontent over late 20th century capitalism, we are seeing major tectonic shifts in global trade patterns. The US and China are slowly decoupling as a consequence of the trade war and China’s largest trading block partner became ASEAN at the beginning of 2020. This means supply chain realignment and moves towards localisation driven by nationalist politics and an intention to build resilience and avoid single points of failure. From an IP perspective this means new flows of technology and know-how, new supply relationships and new risks.

2. Digitalisation

Perhaps the 21st century’s most fundamental mega-trend, digitalisation is transforming all businesses - the way they engage with their customers, consumers and workforce. Traditional product businesses of last century are morphing into product + services or service-only businesses. The role of IP in creating, protecting and maintaining competitive advantage is changing. New intellectual asset classes – particularly data – are being created causing massive shifts in where value resides and how value is created in businesses. And this means new thinking and new strategies are required for controlling those assets.

3. AI & machine learning

Only appearing at the beginning of the decade, we are seeing businesses embed AI and machine learning within more and more functions. This is leading to many changes relevant to IP: AI-generated ideas, technology and content; richer, smarter machine searching and analysis; data-analytics-based assessment of legal risk; and data-analytics-based legal outcome forecasting to name but a few. All require careful consideration in terms of risk and opportunity.

4. Environmentalism and climate change

Likely the greatest global challenge this century, the fundamental reassessment of businesses’ own impact on the environment and the stakeholder to whom they are accountable, beyond their shareholders, is at the beginning of this decade not a direct force on IP and IP service provision. But as businesses look to develop offerings that are sustainable from an environmental impact point of view, we expect an even greater focus on the intangible and intellectual resources that the business draws upon to deliver the offering and to create value, aligned with a continuing shift from product-only to product + service or service-only offerings.

So, where next?

This is the backdrop against which we are asking what the in-house IP team of 2025 should and will look like.

Over the coming weeks and months, we will be exploring these key dimensions – internal forces, IP services market forces and external forces – and looking in detail at the impact they will have on IP teams and/or how IP teams should be reorganising to meet or anticipate their business’s future needs.

We will also be bringing in external voices to deepen the debate, from in-house IP leaders, from academia, and from business more widely.

There are no right answers, but failing change, adapt and develop seems destined to push in-house IP teams even more firmly into the cost-centre, risk management department and away from the real debate about what intangible assets bring to business.

Join the conversation: #IPTeamOf2025